Train risk models for situations you've never seen before

99% of risk models are failing today. Internal data is not enough to face uncertainty. Tap into our collective data network to give your models superpowers.

Get startedRun backtest

99% of risk models are failing today. Internal data is not enough to face uncertainty. Tap into our collective data network to give your models superpowers.

Get startedRun backtest

How do customers benefit from this?

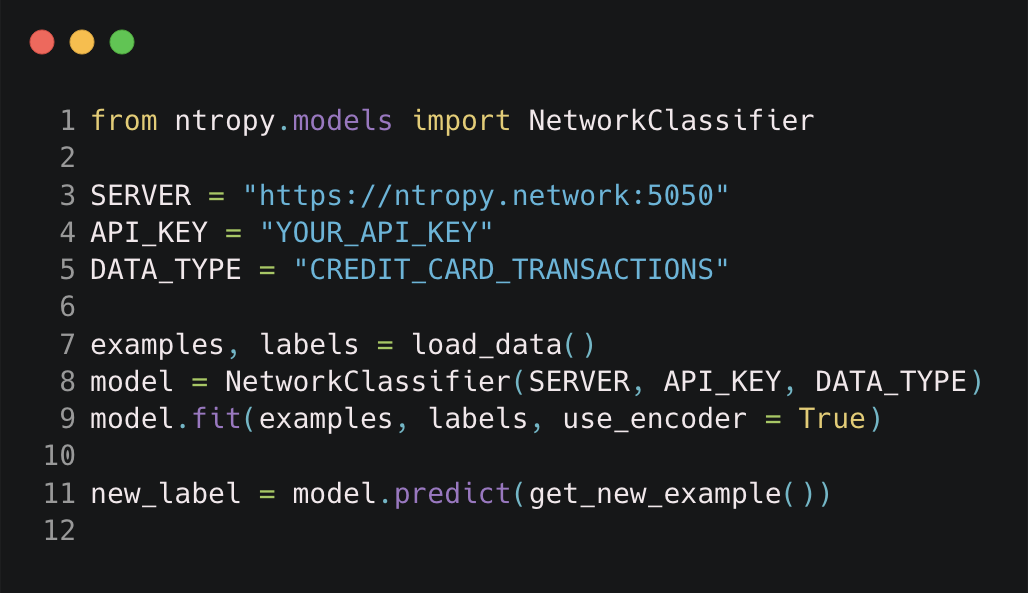

Catch more fraudulent transactions without increasing the rate of false positives or sacrificing customer experience.

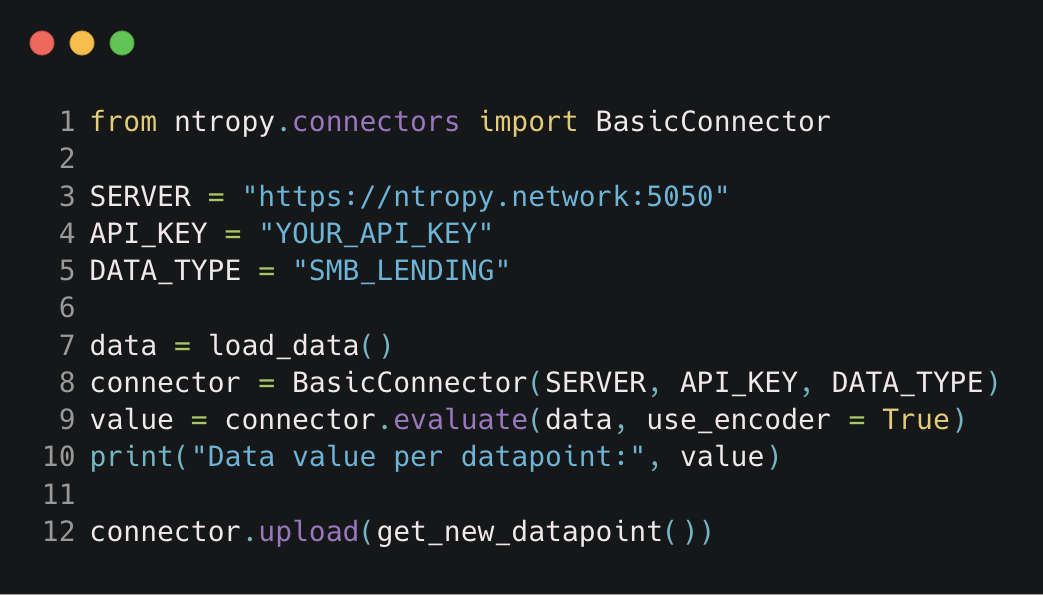

Access aggregate data from operations, sales and transactions to better understand a business.

Skip the cold start and onboard new customers like you have known them long before.

Access cross-domain, cross-organizational data without engineering roadblocks or privacy concerns. Enable superior models that are more accurate and robust to outliers.

Watch videoMonetize your data assets without revealing sensitive information. Discover additional revenue streams and market opportunities.

Watch video

Enrich your data without the hassle

No. We do not buy or sell any data. The network stores information learned from different datasets in a single global model which can then be queried to access deep structural knowledge for each use case.

We are focused on datasets that can add relevance to assessing different forms of risk in finance.

No identity information is stored or transacted in any way. Our platform relies on statistical similarity, rather than information abut any specific entity. This allows for inference over situations that have never before been encountered and enables all models in the network to operate in conditions which have never before been possible.

The value is determined according to how much it improves the performance of the global model. Our data evaluator suite allows you to test and track this in real time.